Preparing for death

Last year a close friend passed away and I became the executor for his estate. He knew his time was limited and could maybe have done a few more things to prepare. I'm listing some of the things I've come across here in the hope that it will help other people in this situation and those that they leave behind.

CAVEAT: None of this should be taken as legal or finanical advice. Consult a professional. Rules vary by country and state.

Digital footprint

We each have a large, complex 'digital footprint' consisting of bank accounts, bills, social media, loyalty programs, ... and it's increasingly hard to find, transfer or shutdown each of those accounts after death. Two-factor authentication, password reset questions, ... and many other aspects of the way websites are created these days make everything harder for those tasked with cleaning them up.

Things to do before you die

- Close out as many accounts as you can. Quora, LinkedIn, Reddit, Cragslist, ... just close them all as soon as you can.

- Move as many accounts as you can to those you will leave behind or at least add your beneficiaries as joint owners on the account so that they can operate the account after you have gone (especially utility bills).

- Make a giant list with everything those left behind will need to know. Bank accounts, social security numbers, dates of birth, places of birth, answers to memorable questions, ...

- Make sure your 401k or retirement accounts have named beneficiaries. If they do, the money can go straight to those people bypassing probate.

- Make sure your bank accounts are designated Joint Tenant With Rights of Survivorhsip (JTWROS) where that matters, otherwise your business partner, say, might be locked out when you die until after the estate is settled.

- Make sure your house title and car registrations are in joint names. Even better, can you put any of them in your beneficiaries names before death by gifting them? It might not save any tax but it will save your executor from a bunch of work.

- If you elected online statements from your bank, turn it off right away and go back to paper statements. On death all your accounts may need to be closed and reopened as a single 'Estate of ...' account. When that happens your executor loses access to online banking and although you can request copies from the bank that takes time.

- Make sure you have a register of checks written especially for taxes, home improvements and other items that will matter next year and possibly for longer. A bank statement with just "Check 1234 $567.89" is no use whatsoever in trying to figure out how much estimated tax you paid last year.

- Do your taxes early, or at least all the preparation work so your executor can just complete them and file them right away.

- Prepay insurance and other bills for several months so that nobody loses their cellphone account, or gets overdue fees during the months it will take to sort everything out.

- If you are leaving kids behind, make sure they have their own bank accounts, debit cards and credit cards if possible. As soon as they reach 18 convert those accounts into adult accounts so that they can have check books and other banking features that aren't available to minors. (You should do this anyway - educate your kids in money matters as early as possible).

- Make a file with every certificate and legal document your executor or kids might need when you are gone: birth certificate, marriage certificate, passport, ...

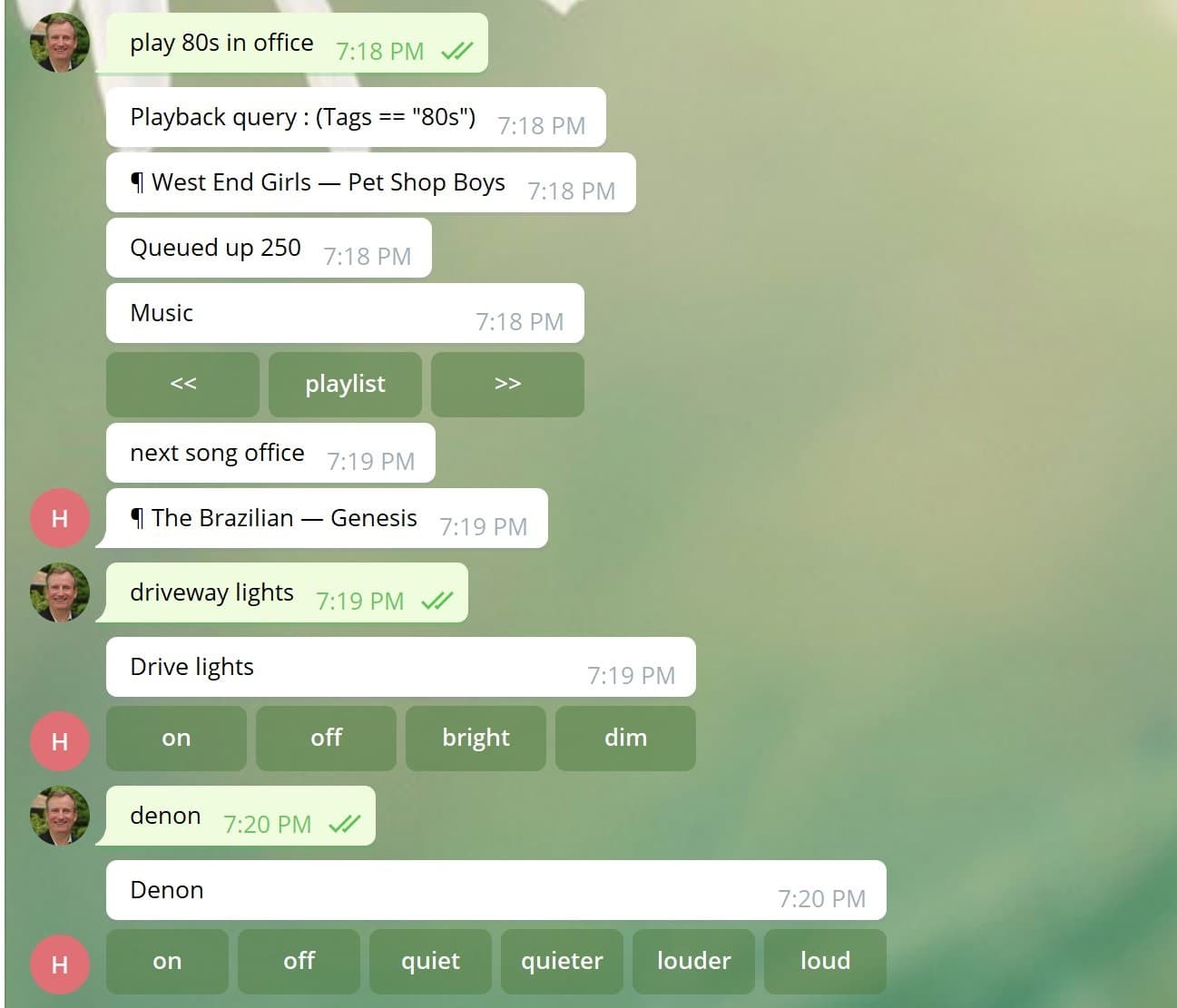

- Make a list of online accounts, usernames, passwords, ... and note what should happen to each when you are gone.

- Make a list of assets and the value of each: cars, jewlery, art, ... including any appraisals you have for them.

- Spend all your airmiles and loyalty points as you go along. The benefit from using them for travel typically outweighs any other benefit, but most of them cannot be transferred after death as travel points, some are lost entirely and some may be redeemable for gift cards. If you have any left and can convert them to gift cards, do it now, and give the cards to your beneficiaries directly! Sometimes the only option is to donate the points to charity, do that now too, don't wait, it's one less trouble for those you leave behind.

- Create a digital archive with all the electronic documents that might be useful to your successors. Past tax returns, copies of agreements, certificates, ... put it on an SD card and put it in dropbox or somewhere else with a secure password. Write that password down, put it in an envelope and make sure people who where to find that envelope.

- Sell assets: start the garage sale now and turn as many unwanted items into cash.

If anyone reading this has any other suggestions, drop me a note on Twitter @ianmercer and I'll try to add them.